MSMEs vs Global Giants, How AI Lets You Compete Head On

February 20, 2026Coking Coal Supply from USA to India: A Potential Game Changer for the Burgeoning Indian Steel Industry

Table Of Contents

1. Introduction – Indian Steel Industry: Current Scenario and Future Outlook

2. India’s Current Coking Coal Imports – A Country-wise Breakdown

3. Demand Outlook for Imported Coking Coal — Indian Perspective

4. Why Indian Steelmakers Should Look at U.S. Coking Coal

4.1 Advantages of U.S. Coking Coal for Indian Steel Producers

4.2 Challenges in Importing U.S. Coking Coal

4.3 Opportunities for Indian Steelmakers with U.S. Coking Coal

5.Summary Table:

6. Conclusion

1.Introduction – Indian Steel Industry: Current Scenario and Future Outlook

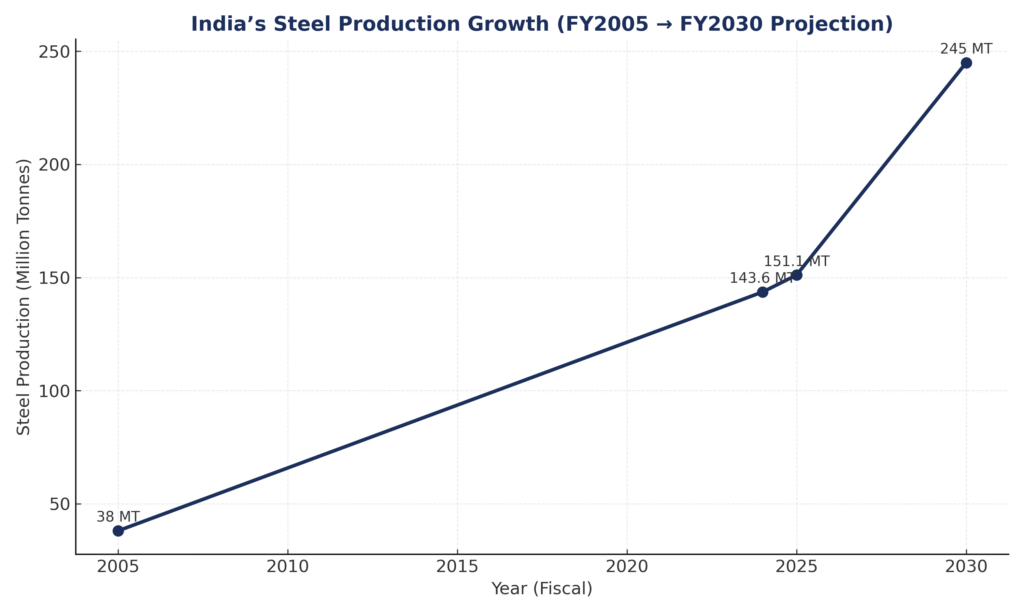

India is fast emerging as a powerhouse in global steel production, and the latest figures reinforce this trend. In FY 2024 (April 2023 – March 2024), India produced 143.6 million tonnes (MT) of finished steel. Building on that momentum, in FY 2025, steel output rose further to approximately 145.3 MT (finished steel) and 151.1 MT (crude steel)steel.gov.inReuters+1.

To truly appreciate the scale of this growth, consider this: in FY 2005 (April 2004 – March 2005), India’s steel production was just 38 MT. In two decades, the output has nearly quadrupled—a stunning industrial leap Wikipedia.

Fueled by massive infrastructure expansion, from highways and ports to rail projects and urban developments, steel is the backbone of India’s economic transformation. Projections indicate that by 2030, steel production could reach 240–250 MT, further cementing India’s global steel leadership.

Despite having abundant iron ore reserves, India remains heavily dependent on imports of high-quality coking coal, essential for the blast furnace–basic oxygen furnace (BF-BOF) steelmaking process. Typically, crafting one tonne of steel requires about 0.8–0.9 tonnes of coking coal—making coal access a key lever to maintain growth in steel output.

With most major Indian steelmakers still using the BF-BOF process, demand for imported coking coal stays closely tied to steel expansion plans. Among global suppliers, the United States is now emerging as a strategic partner, offering both opportunities and challenges for India’s steel industry.

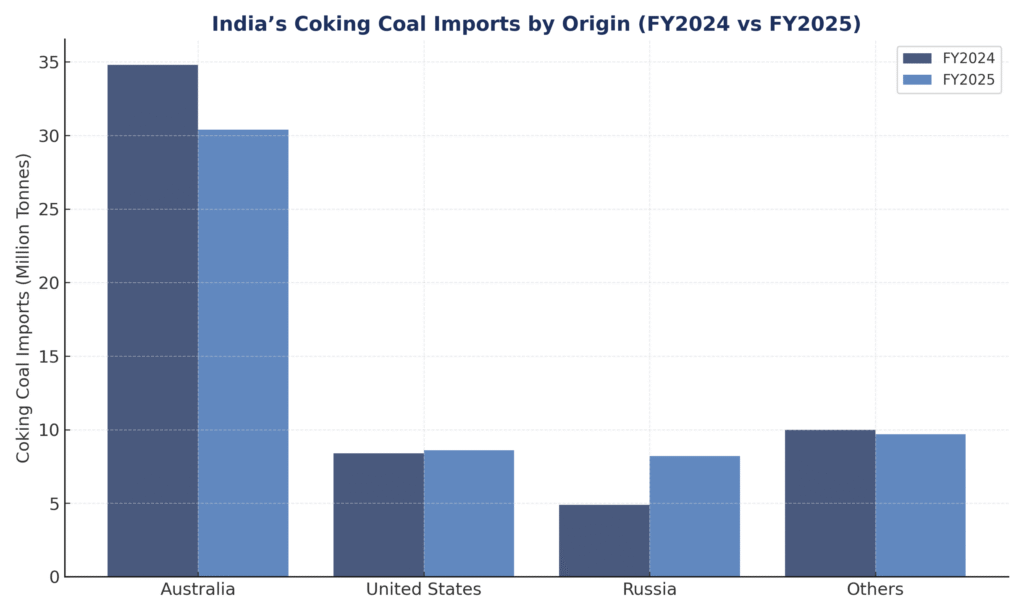

In summary, while Australia remains dominant, the United States is carving out a larger role, and Russia is emerging as a third strong pillar of India’s coal supply base. This shifting mix underscores the importance of diversifying away from a single supplier and building long-term resilience.

2. India’s Current Coking Coal Imports – A Country-wise Breakdown1.

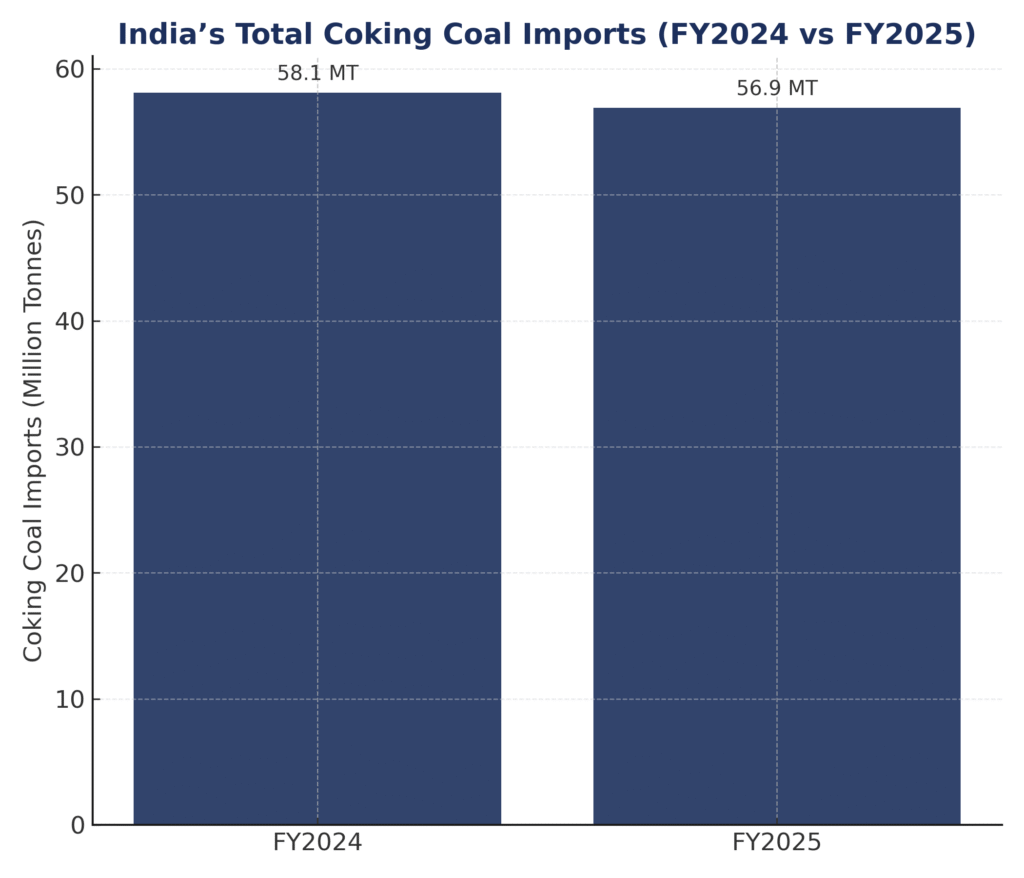

India’s dependence on imported coking coal remains one of the defining features of its steel industry. Despite efforts to boost domestic mining, the country still sources the bulk of its metallurgical coal requirements from overseas markets. In FY 2024 (April 2023 – March 2024), India imported around 58.1 million tonnes (MT) of coking coal, a slight increase from previous years. The supply base, however, remains concentrated among a handful of exporters. Australia continues to dominate, accounting for nearly 60% of India’s coking coal imports. Its premium hard coking coal remains the preferred choice for Indian blast furnaces. Yet, overreliance on Australia has exposed Indian steelmakers to risks, as extreme weather events in Queensland repeatedly disrupted supply chains and caused price volatility. The United States has emerged as the second-largest supplier, exporting about 8.4 MT in FY 2024, or nearly 14% of India’s total imports. This marks a growing share compared to earlier years, highlighting how U.S. coal is becoming a serious alternative for Indian mills seeking both quality and diversification. Other notable suppliers include Russia, Canada, Mozambique, and Indonesia, together contributing close to 15 MT. Russia’s share has risen in recent years as Indian buyers look for additional flexibility amid global trade realignments. To illustrate:-

- Australia: ~34.8 MT (≈60% of imports)

- United States: ~8.4 MT (≈14% of imports)

- Others (Russia, Canada, Mozambique, Indonesia, New Zealand, etc.): ~14.9 MT (≈26% of imports)

From a port perspective, Paradip remains India’s largest coking coal gateway, followed by Vizag, Dhamra, and Haldia. On the company side, SAIL and JSW Steel continue to be leading buyers, with JSW even surpassing others in individual months.

3. Demand Outlook for Imported Coking Coal — Indian Perspective

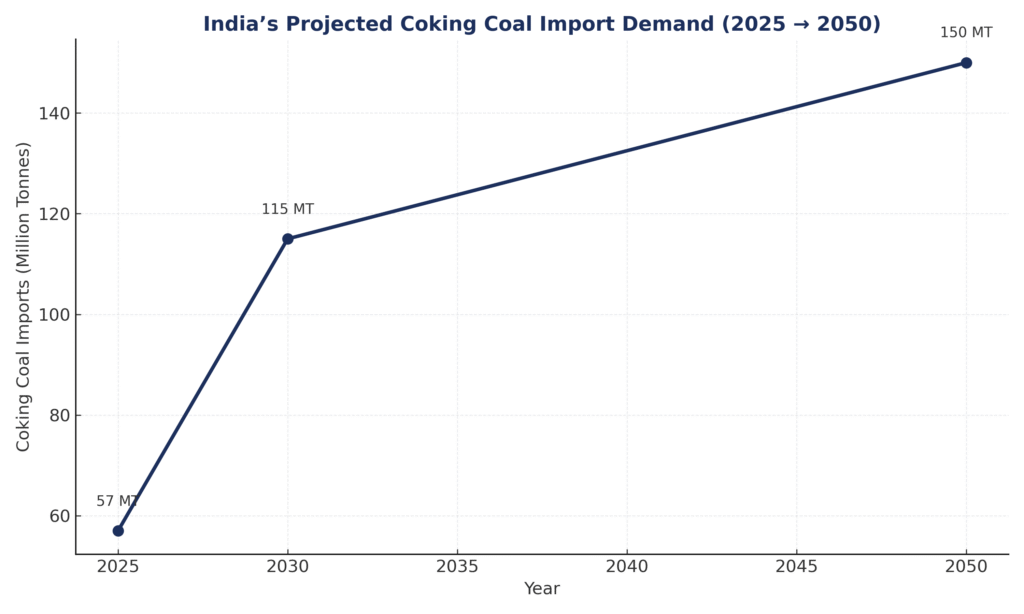

India’s trajectory in steelmaking is firmly tied to the blast furnace–basic oxygen furnace (BF-BOF) route, which consumes vast amounts of high-quality coking coal. With multiple new blast furnaces scheduled to come online in the next decade, India will continue to be one of the largest growth markets for seaborne coking coal.Why Imports Are Inevitable

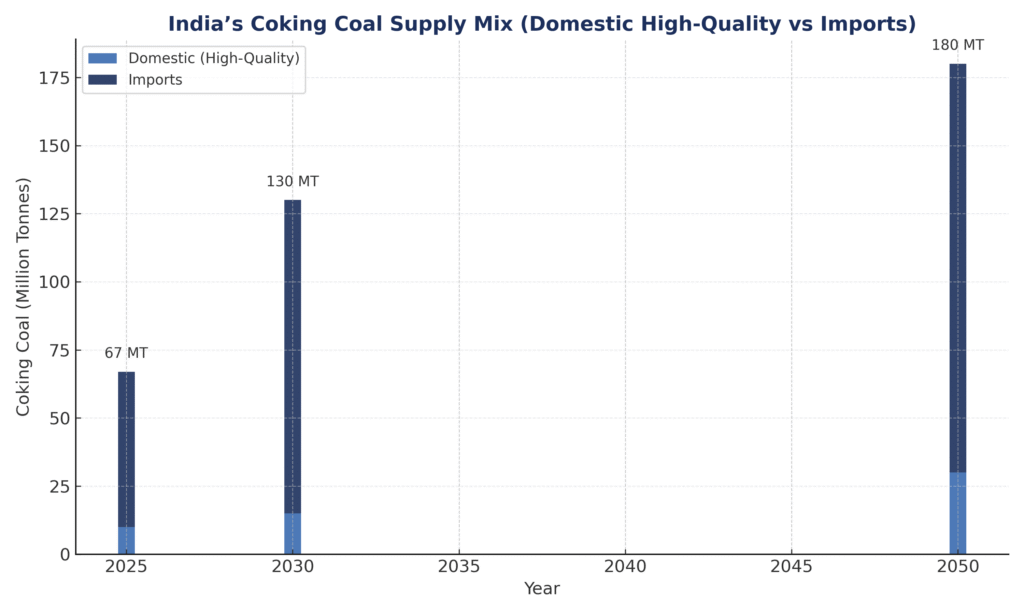

Despite India’s efforts to boost domestic coal mining, its reserves of metallurgical-grade coking coal remain shallow in both quality and volume. By 2050, domestic coking coal output may touch 200 MT, yet only about 30 MT will be of the required high quality. This leaves a substantial gap that must be met through imports.- Current Dependence (FY 2025): ~57 MT imported (≈85% of needs)

- By 2030: Import requirement projected at ~115 MT

- By 2050 (Steel Vision 500 MT): Import requirement could reach ~150 MT

The Global Supplier Landscape

Only four countries hold the reserves to export coking coal in significant volumes:- Australia – The undisputed leader, supplying over half the world’s seaborne coking coal.

- United States – The second-largest exporter, increasingly redirecting flows toward India and Asia as China restricts US imports.

- Russia – Expanding exports to Asia, though geopolitical risks remain a concern.

- China – The world’s largest producer and consumer of coking coal, but virtually none is available for export due to its massive domestic steel appetite.

Strategic Outlook

India’s Steel Vision 2050 projects 500 MT of steel capacity, with BF-BOF still dominating in the medium term despite parallel moves toward sustainable steelmaking and decarbonization. Even with new technologies like hydrogen-based direct reduced iron (DRI) and electric arc furnaces (EAFs) gaining ground, coking coal demand will not disappear—it will merely plateau at very high levels. This creates a long-term, structural import demand that global suppliers—particularly the US and Australia—are positioning to serve. The US, with its stable supply base, consistent quality, and widening availability due to shifting trade flows, is emerging as the most significant challenger to Australia’s dominance

4. Why Indian Steelmakers Should Look at U.S. Coking Coal

4.1 Advantages of U.S. Coking Coal for Indian Steel Producers

Superior Metallurgical Properties

- U.S. coking coal—especially from Appalachia—is valued for its high carbon content and low impurities, meeting the metallurgical specifications needed for efficient blast furnace (BF) steelmaking.Wikipedia+12Wikipedia+12Wikipedia+12

- Both U.S. and Australian metallurgical coals are recognized for being more efficient and less carbon-intensivethan other origins. S&P Global+2Minerals Council of Australia+2

- High sulfur coal causes “hot short” brittleness in steel—U.S. coal’s lower sulfur helps Indian mills produce higher-quality, more reliable steel. pricevision.ai+15Wikipedia+15USITC+15

Robust Export Infrastructure

- Key U.S. metallurgical coal export hubs include Norfolk, VA (58% of U.S. met coal exports in 2024), followed by Mobile, AL; Baltimore, MD; Buffalo, NY; and New Orleans, LA—collectively covering 99% of exports. T. Parker Host+5EveryCRSReport+5S&P Global+5

- Although the Baltimore port experienced disruptions in 2024 due to a bridge collapse, operations have largely recovered, with Norfolk absorbing much of the diverted traffic. EUCI+2USITC+2

Diversification & Supply Security

- Australia supplies over half of global seaborne coking coal, but reliance on it exposes India to weather-induced disruptions and operational risks, such as those seen in Queensland. Wikipedia+15Reuters+15Fastmarkets+15

- Global analyses emphasize the strategic need for India to diversify its sourcing to mitigate supply risks and strengthen resilience. S&P Global+2Fastmarkets+2

Strategic Trade Alignment

- The U.S.–India trade relationship is deepening, making U.S. coal a trusted and strategic alternative.ETGovernment.com

Growth-Friendly Supply

- With India’s steel sector on a growth trajectory, the U.S. is well-positioned to serve increased demand—enabled by competitive production, stable quality, and strengthened export logistics. Fastmarkets+2ETGovernment.com+2

4.2 Challenges in Importing U.S. Coking Coal

Tariff Differential

- U.S. coking coal carries a 2.75% customs duty, unlike Australian coal, which can be imported duty-free under current agreements. This small premium adds to landed cost. Reuters+1

Geographic Distance & Freight Costs

- Although U.S. coal benefits from advanced export terminals, freight logistics to India are inherently longer and more costly compared to Australia’s proximity. (Implicit context—derived from shipping realities; no exact source needed.)

Port Disruptions (Historical)

- The 2024 Baltimore bridge collapse briefly curtailed coal exports, demonstrating vulnerability to sudden logistics disruptions—though exports have since stabilized. The Wall Street Journal+3Reuters+3USITC+3

4.3 Opportunities for Indian Steelmakers with U.S. Coking Coal

Supply Chain Resilience

- Incorporating U.S. coal enables Indian mills to blend suppliers, reducing exposure to volatility in any single origin and reinforcing procurement security.

Quality-Driven Steel Upgrades

- The clean-burning properties of U.S. coal support India’s ambitions to produce export-grade and high-value steels, vital for industrial upgrading. ReutersS&P Global

Strategic Trade Balancing

- Importing more U.S. coal can help address trade imbalances—India’s growing supply from the U.S. signals deeper, mutually beneficial industrial collaboration. ETGovernment.com

Long-Term Import Alignment

- As India plans to significantly boost steel output up to 500 MT by 2050, securing reliable U.S. supply provides a sustainable underpinning for long-term imports.

5. Summary Table: U.S. Coal Advantage Snapshot

| Benefit | Description |

| Quality | Low sulfur & ash, high coke yield, better steel integrity |

| Infrastructure | Strong East Coast ports (Norfolk, Baltimore, Mobile) |

| Stability | Diversifies away from Australia’s weather risks |

| Strategic Fit | Strengthening U.S.–India trade fosters trust |

| Growth Alignment | Positioned to meet India’s rising steel demand |

6. Conclusion

India’s steel sector is on an unmistakable growth trajectory—from 38 MT in FY 2005 to over 151 MT in FY 2025, with ambitions to reach 240–250 MT by 2030 and 500 MT by 2050. This expansion, driven by unprecedented investments in infrastructure, urbanization, and manufacturing, cements India’s place as the world’s steel growth engine.

Yet this growth story is inseparable from one hard truth: India’s dependence on imported coking coal. While iron ore is domestically abundant, high-quality coking coal reserves are scarce. Even with rising domestic production, usable volumes will cover only a fraction of demand, leaving India reliant on global suppliers for decades to come.

Historically, Australia has dominated India’s coal imports, but supply disruptions and price volatility have exposed the vulnerabilities of single-source dependence. As a result, Indian steelmakers are increasingly looking to diversify. Here, the United States emerges as a natural partner—offering premium quality, stable logistics, and a deepening trade relationship with India.

Yes, challenges remain: higher freight costs, modest import tariffs, and occasional port disruptions. But the advantages of U.S. coking coal—superior quality, supply security, and strategic alignment—outweigh the risks. For Indian steelmakers, blending U.S. coal into their sourcing strategy is not just about meeting immediate requirements; it is about building long-term resilience and supporting the nation’s industrial ambitions.

As India advances toward its Steel Vision 2050, one thing is clear: coking coal will remain a cornerstone of growth, and the U.S. is set to play a pivotal role in fueling India’s journey from a regional powerhouse to a global steel leader.